My experience investing in Kickfurther co-ops

Posted by Kimberly on Feb 14, 2020 in Personal Finance | 3 commentsWhen I learned about Kickfurther, I was excited to invest in promising scaling companies and startups that offer co-ops there. Over the past two years, I’ve invested in 14 of them. The results are underwhelming, to say the least, and I don’t plan to continue to invest there. Here’s why.

How Kickfurther works

On Kickfurther, investors purchase small bundles of inventory on consignment. You don’t really get your hands on any merchandise (except in the worst-case scenarios, and I’ll get to that in a moment). The company keeps its merchandise and sells it through the usual channels.

As sales are made (and on a predetermined schedule), the company makes payments to Kickfurther. Kickfurther then distributes the funds to investors in proportions that match the investments. Once the last payment has been made, investors have their original investment back in hand, plus a small profit (the promised profit varies with each co-op).

When Kickfurther succeeds

My very first investment was in a company called United Streets of Art. At first, payback didn’t go as planned. Right away some of the investors started trashing the business owner in comments and voting “no confidence” (a passing vote of no confidence forces the company to immediately satisfy the obligation, either with cash or by relinquishing all consigned merchandise to Kickfurther). Honestly, I didn’t understand why other investors were so quick to crucify. Now I get it. I’ve since learned that some of the business owners seriously misrepresent (deliberately or by virtue of their naivete) themselves, their abilities, their history, and their product.

In this case, based on the owner’s explanation of the situation, I remained optimistic and lent him my moral support. Eventually, he paid in full, and we all earned an annualized 19.8% return on investment.

Several other companies I invested in also successfully completed their paybacks. Yay!

But all investment carries risk, as we know. The problem with Kickfurther, of course, is the potential for large losses if even a single investment fails.

When Kickfurther fails

A co-op can fail for any number of reasons. One of my co-ops is troubled right now (Best of Times) because of the Trump tariffs on Chinese goods. Another (Tech-Life) is on a very long and drawn out repayment schedule because they received an unexpected and huge return of goods (not the consigned product) that threw their entire financial plan off course. Yet another (Trusst) is failing because the product was designed so poorly that customers are returning it in large numbers (this company represented its design as having been highly refined and thoroughly tested over the course of many years).

A vote of no confidence is not a good outcome. If a co-op is canceled this way, the company can fulfill its financial obligation by relinquishing the merchandise. (For example, thousands of bras that don’t fit.) The company is then off the hook and Kickfurther attempts to liquidate the merchandise, invariably at a steep loss.

Kickfurther’s personal guarantee

Since most co-ops are backed by a personal guarantee by the company’s owner, it seems that there is a safety net built in. There isn’t.

The personal guarantee only goes into effect if the business doesn’t resolve the co-op obligation. As I just explained, a business with a canceled co-op can return unsold inventory to satisfy its obligation. Even, apparently, shoddy merchandise. Therein lies the problem.

As investors, we are, of course, universally on notice that all startups are selling something that people might not want to buy. Fair enough.

But I think merchandise quality and saleability should be factors that are evaluated if a company wants to return merchandise rather than be held financially accountable by way of the personal guarantee. This is a key shortcoming of Kickfurther. We, as investors, have purchased the inventory. No matter what. Buyer beware. Once a co-op is funded, Kickfurther does not have a process in place to evaluate whether the product meets expectations, or a plan B if it doesn’t.

The bottom line is that the personal guarantee is essentially useless in nearly every co-op.

More problems with Kickfurther

Since investors technically don’t invest in growth but rather purchase inventory on consignment, it would stand to reason that we would have an opportunity to help the company make sales, or possibly even to make sales ourselves, yes? Theoretically, I would even be able to sell the actual item I purchased, thereby earning back my investment and profit independently from all other investors.

No.

Kickfurther promised a digital storefront to each investor so that we could promote sales using our own links. Their website reads, “You have the ability to sell the products alongside the brand with your own Kickfurther store alongside the brand [sic] selling the products as they normally would.”

No functional store has ever been built, although they have promised many times that it is near completion. Click the link in the paragraph above to see for yourself.

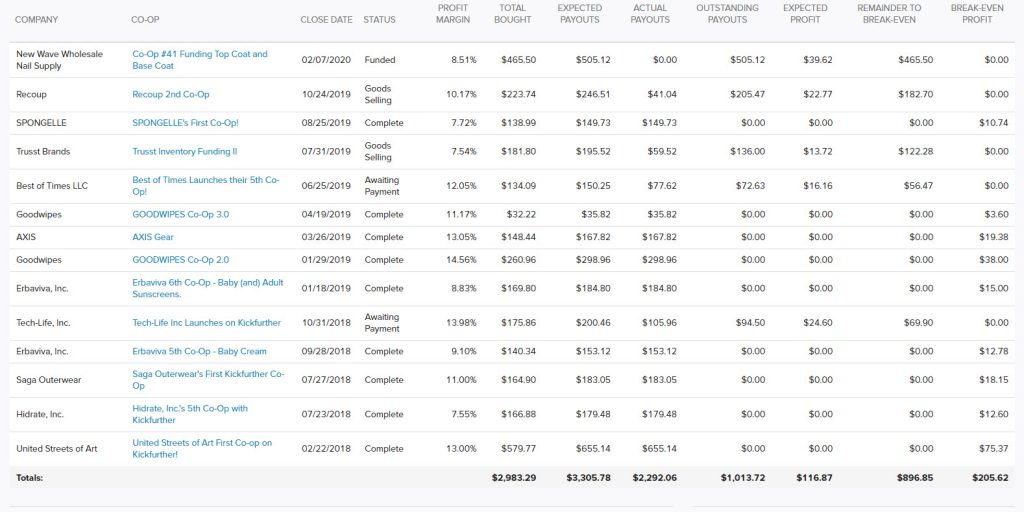

My Kickfurther results

If all were well with my co-ops, I’d earn a profit of about 11 percent (the annualized ROI would be higher; most co-ops complete in well under a year). In dollar amounts, I’d net $322 on investments totaling $2,983.

All is not well. I invested in three co-ops that are likely to result in losses (one is almost certainly in the toilet).

Best of Times reports that the business is no longer viable due to the China issues. The coronavirus has hampered their supply chain even more than the tariffs. The owners are lovely people who promise to repay in full, but they owe more than $94,000. Time will tell.

Tech-Life, the company on the long payment plan, no longer has the consigned merchandise. They sold it and spent the money, and then a customer unexpectedly returned a large order of something else. So Tech-Life’s owners are on the hook legally to satisfy the debt. They owe $31,500 and are making modest $950 monthly payments. A balloon payment is due later this year and I’m not holding my breath.

Trusst, the worst failure of the bunch, is currently attempting to sell its intellectual property, which along with the bras is its only asset. Finding a buyer for a product idea that doesn’t sell is predictably challenging. The merchandise is poorly designed and returns are high. They have let go of the entire staff. They discontinued their website due to lack of funds to keep it running. They halted all marketing efforts. They are angry with any investor who questions their managerial abilities or integrity. The owner whines that he’s gone without pay recently. In a note to the Kickfurther community, he wrote that an offer to settle the debt will not be forthcoming. He plans to walk away and not honor his commitment to repay the co-op. Because he had to work without pay. And he considers his own risk and losses to be much greater than ours. Ugh. I could go on but you get the idea.

If these three companies are unable to repay, my promised profit will drop by half.

All in all, my mutual funds at USAA and Vanguard reliably perform better. That shouldn’t surprise any conservative investor. To be sure, I never really expected Kickfurther to live up to the hype of double-digit returns on small-dollar contributions. But one can always hope, right?

What do you think?

| My Kickfurther results | |

|---|---|

| Number of co-ops | 14 |

| Number troubled | 4 |

| Number not likely to repay | 2 |

| Average annualized ROI for completed co-ops | 17.38% |

| Actual annualized ROI overall | -0.095 |

How can these thieves still be in business?!! I hope they end up in jail soon.

Great article. I came across it when one of the coops I’m investing in (J2 Medical Supplies Coop 3) is looking hopeless. I’ll be steering clear of the platform in the future.

Same here. I am in TWO different J2 Medical coops. It is not looking good. Uweport just got cancelled with a $400,000.00 coop without paying back one dime. I am on my way out also.